EuroCham Myanmar’s Legal & Tax Advocacy Group Breakfast Talk on the key legal and tax developments to look forward to in 2021

On January 20th, the Legal and Tax Advocacy Group of EuroCham Myanmar hosted the Legal and Tax Breakfast Talk, presenting a summary of the key legal and tax developments of 2021 and developments to look out for in 2021.

The Legal & Tax Breakfast Talk is a Quarterly event, hosted by members of the Legal and Tax Advocacy Group. Bringing together 9 European firms – Audier & Partners, Charlton’s Law, Dentons, DFDL, EY, LUTHER Law, METRO, Prudential and PwC – the group aims to provide EU companies with a platform for constructive dialogue with the public sector on legal and tax issues and advocate for reforms aimed at enhancing competitiveness and to improve the business environment in Myanmar.

In this session the experts briefly presented on the key changes in the legal and tax landscape in 2020 in Myanmar. Ms. Ling Yi Quek, shared the key insights for companies to look out for which include key changes from the new Trademark Law, the revised Consumer Protection Law, and the key regulatory developments from the 2020 Insolvency Law that are crucial in aligning the Myanmar framework with international framework in the scope of corporate insolvency. She highlighted key regulatory developments for foreign investors to anticipate in 2021 such as the Myanmar Economic Resilience and Reform Plan (MERRP), e-commerce operation guidelines and the draft National Land Law.

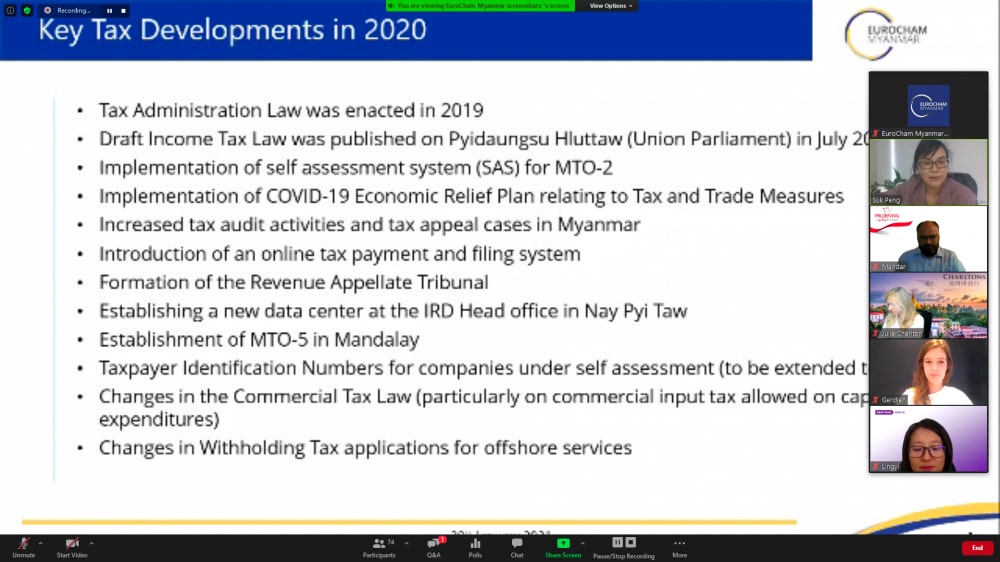

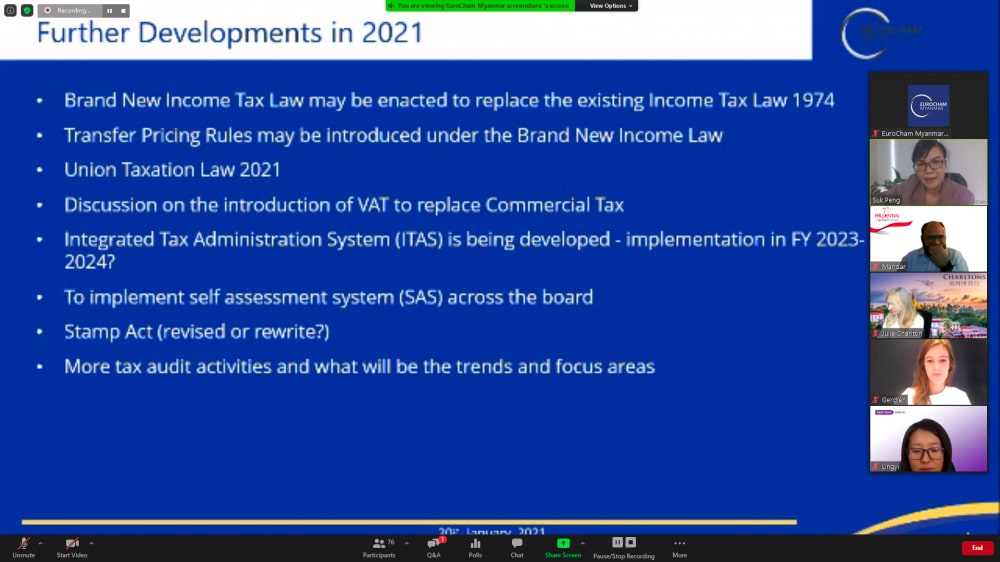

Ms. Suk Peng Ding, PwC, shared that 2020 saw many developments in terms of tax. She highlighted key developments and provisions for companies to be aware of particularly from the draft 2020 Income Tax Law and the Self-Assessment System. She further provided key insights on the impact that COVID 19 has on the tax landscape in Myanmar in terms of the government efforts to establish a clearer and convenient communication platform between taxpayers and the government. She then presented other key developments for companies to anticipate for, which include the changes in commercial tax and withholding tax.

After the presentations all experts joined in the Q&A, moderated by Mr Mandar Hastekar of Prudential. Joining in for the discussions were Ms Julia Charltons-Charlton’s Law, Mr. Diber John Balinas- DFDL, as well as Ms. Ling Yi Quek-Dentons, and Ms Suk Peng Ding- PwC and co-chair of the Legal and Tax Advocacy Group Mr. Nishant Choudhary of DFDL. The panel discussed the anticipated changes for 2021 in terms of e-commerce infrastructure, payment digitalization and tax filing procedure. The panel also discussed potential legal and tax implications that could result for the companies from the recent developments presented. They then provided insights on the potential changes in the legal and tax provisions and tax reliefs for businesses to look forward to in Myanmar in light of the ongoing COVID 19 pandemic and the draft income tax law which is expected to be enacted in near future.

No Comments

Sorry, the comment form is closed at this time.